north carolina estate tax 2020

See below for a chart of historical Federal estate tax exemption amounts and tax rates. The exemption is portable for spouses meaning that with the right legal steps a couple can protect up to 2236 million upon the death of both.

9114 Ballotade St Upper Marlboro Md New Homes Waterfront Homes Ryan Homes

If you live or work in NC when you die your estate may be subject to these taxes.

. The federal estate tax exemption is 1206 million in 2022 so only estates. Use our free North Carolina property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Then print and file the form.

North Carolina state income tax Form D-400 must be postmarked by April 15 2021 in order to avoid penalties and late fees. However now that North Carolina has eliminated its estate tax most wealthy North Carolina residents will owe estate taxes only to the federal government. Complete this version using your computer to enter the required information.

Thus for deaths occurring on January 1 2013 or later only the Federal estate tax rules apply for North Carolina decedents. Owner or Beneficiarys Share of NC. Beneficiarys Share of North Carolina Income Adjustments and Credits.

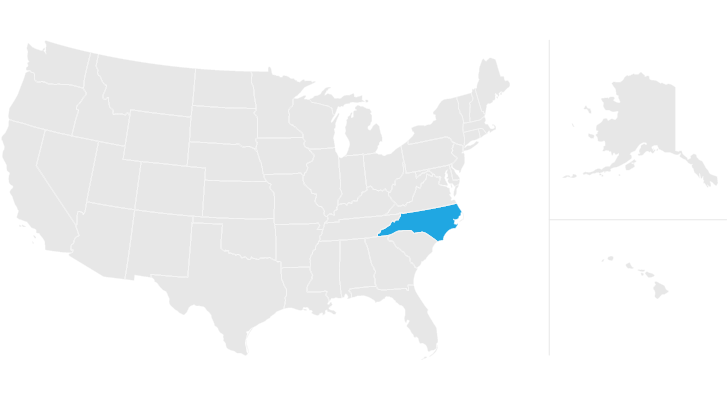

North Carolina does not collect an inheritance tax or an estate tax. 2021 State Transportation Tax Changes North Carolina. NC K-1 Supplemental Schedule.

The North Carolina Homestead Exemption Amount. The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. The North Carolina income tax rate for tax year 2020 is 525.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Homeowners age 65 or older whose spouse is deceased can exempt up to 60000 under the homestead exemption if the property. Tax amount varies by county.

Printable North Carolina state tax forms for the 2020 tax year will be based on income earned between January 1 2020 through December 31 2020. PDF 33221 KB - January 04 2021. That means that any additional income would be taxed at 2925.

Application for Extension for Filing Estate or Trust Tax Return. North Carolina has 1012 special sales tax jurisdictions with local sales taxes in. The current Federal Estate Tax Exemption for 2021 is 117 million per individual.

105-321 - Repealed by Session Laws 2013-316 s7a effective January 1 2013 and applicable to the estates of decedents dying on or after that date. Current Federal Estate Tax Exemption. Our property records tool can return a variety of information about your property that affect your property tax.

However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million. Description north carolina estate tax. If you buy property in North Carolina you may prove subject to the North Carolina real estate sales tax also known as the excise tax.

Under the North Carolina exemption system homeowners may exempt up to 35000 of their home or other real or personal property covered by the homestead exemption. The lifetime gift tax exemption amount is 1158 million in 2020 increasing to 117 million in 2021. Counties in north carolina collect an average of 078 of.

102 rows 2020-21 Property Tax Rate 2019-20 Property Tax Rate. North carolina estate tax 2020. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

The tax rate on funds in excess of the exemption amount is 40. Federal Estate Tax. For the year 2016 the lifetime exemption amount is 545 million.

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75. Additional taxable income may come from interest from bank accounts andor dividends and capital. After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the remaining 155 million taxed at the rate of 40 percent.

On May 31 2018 Connecticut changed its estate tax law to extend the phase-in of the exemption to 2023 to reflect the increase in the federal exemption to 10 million indexed for inflation in the 2017 Tax Act. Prescription Drugs are exempt from the North Carolina sales tax. In July 2020 House Bill 77 became law without Gov.

Discover North Carolina Income Tax Forms for getting more useful information about real estate apartment mortgages near you. Counties in North Carolina collect an average of 078 of a propertys assesed fair market value as property tax per year. While the state excise tax is 02 percent seven counties consisting of Camden Chowan Currituck Dare Pasquotank Perquimans and Washington may levy an optional local real estate sales tax of up to 1 percent.

As a married filing jointly couple in North Carolina you would be in the 24 tax bracket at the federal level and 525 at the state level for a combined tax rate of 2925. Some states still charge an Estate Tax Death Tax. Taxes in North Carolina.

While there isnt an estate tax in North Carolina the federal estate tax may still apply. Estates and Trusts Fiduciary. Any federal or state gift and estate tax due however is paid by the estate during the probate of the estate.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. Most of this laws provisions took effect on July 1 2020 but one provisionestablishing a floor for the gas tax in 2021took effect on January 1 of this year. Roy Coopers D signature.

If you are inheriting from someone in another state your inheritance may also be subject to a state death tax from the originating state. The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to 1206 million for deaths in 2022. Any federal or state gift and estate tax due however is paid by the estate during the probate of the estate.

Even though North Carolina has neither an estate tax or nor an inheritance tax the federal estate tax still applies to North Carolinians depending on the value of. Link is external 2021. 2020 North Carolina General Statutes Chapter 105 - Taxation Article 1A - Estate Taxes.

The exemption will be phased in as follows.

Tour Taylor Swift S Filming Location For Blank Space Oheka Castle Historic Hotels American Castles

North Carolina Estate Tax Everything You Need To Know Smartasset

How Do You Make An Offer On A House You Love Hint Get A Great Real Estate Agent On Board But We Ve Also Got Som Real Estate Agent Estate Agent Make

Wealth Life Insurance For Seniors Life Insurance Policy Long Term Care Insurance

Corsica At Caskey Farm In Lovettsville Va Now Available For Showing By Robert Mcglothlin Build Your Dream Home Real Estate Estate Homes

Estate Personal Property Inventory Form Elegant Estate Planning Inventory Form Sample Estate Planning Simple Business Plan Template Business Plan Template Pdf

You Should Drop Everything And Buy This North Carolina Fixer Upper Historic Homes For Sale Historic Homes Fixer Upper

North Carolina Gift Tax All You Need To Know Smartasset

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Estate Tax Everything You Need To Know Smartasset

Priciest Home Sales In Locust Valley In 2020 Locust Valley Sale House Valley

Does North Carolina Collect Estate Or Inheritance Tax

North Carolina Estate Tax Everything You Need To Know Smartasset

What Comes After A Seller Accepts Your Offer Infographic Real Estate Infographic Real Estate Advice Buying First Home

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

These 7 States Don T Make Residents Pay Income Taxes Capital Gains Tax Filing Taxes Estate Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die